After a week of the new I-SEM market, it has provided quite the roller coaster ride for market participants.

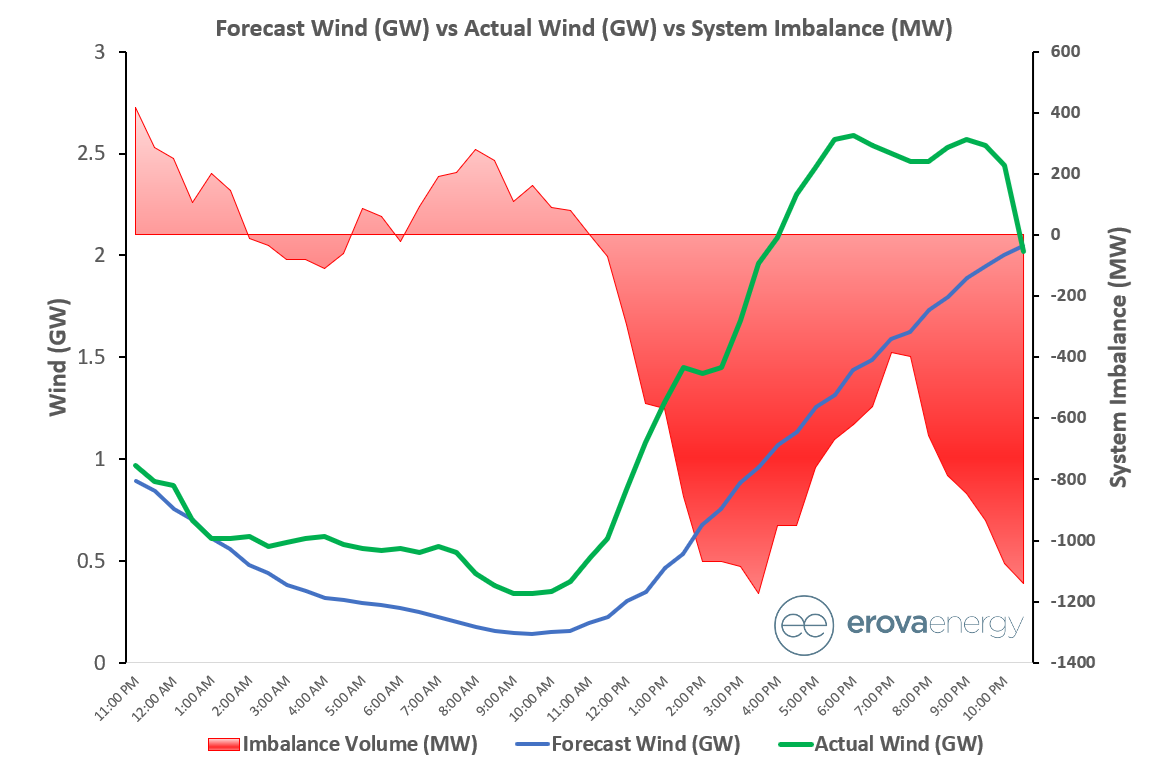

Those suppliers and generators with an increased appetite to risk management and hedging will have been exposed to the extremely volatile (and at times, unpredictable) nature of the balancing market. In general, as mentioned in a our previous post, the wind imbalance is the primary driver of the market imbalance. Given the lack of liquidity in the intra-day auctions and in particular in the continuous market it places increased pressure on wind forecasting accuracy. See below an extreme example of forecast error from October 1, comparing the actual wind with day-ahead Eirgrid forecast there was an 89% forecast error.

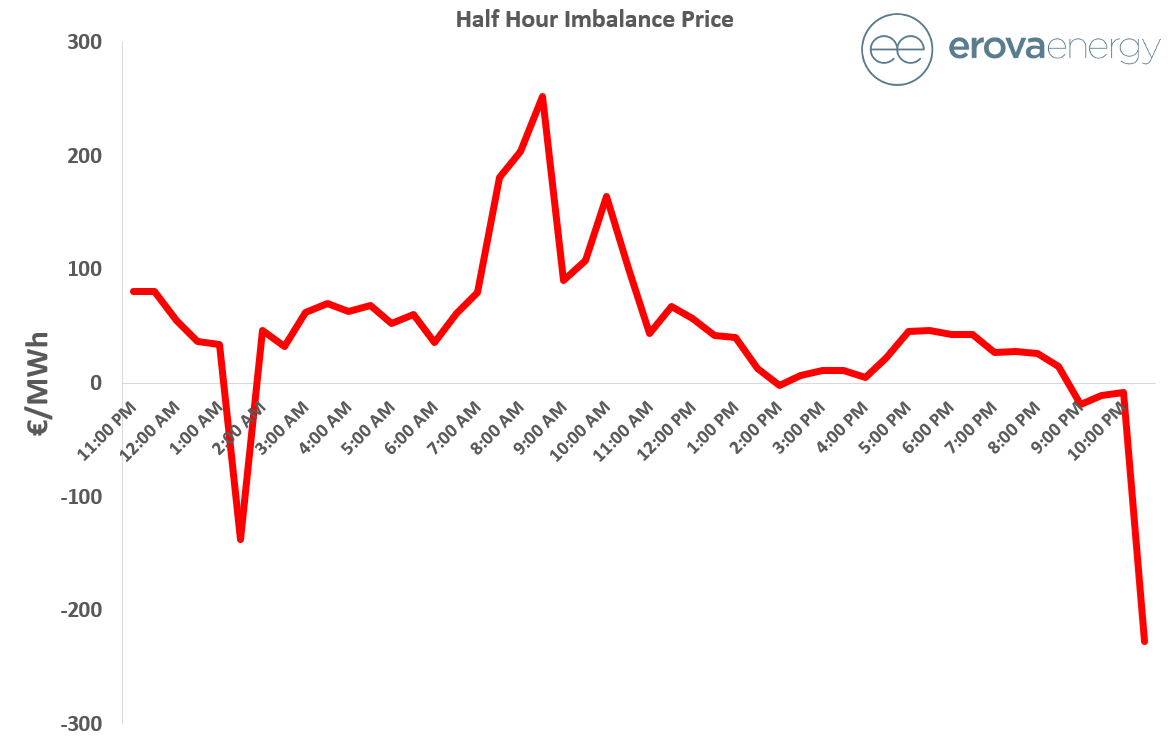

As is evident from the graph, this dispersion sent the system over 1 GW long at periods across Monday evening which explains the below imbalance prices, (an imbalance price of -€226/MWh was recorded at 22.30). This would have proven a taxing evening for Eirgrid / SONI but at least helped un-hedged and even under-hedged suppliers who have been struggling with almost constant commodity price increases.

Liquidity on the continuous market has improved across the week, (on average across the first two days there was an average of only 36MW traded in each half hour on M7 with trading activity in only 79 of 96 trading periods), but still the wind error exceeds the cumulative volumes traded on the intra-day auctions and continuous market which has increased wind generators exposure to the balancing mechanism. In more established markets there is a strong correlation between the imbalance volume and the imbalance price, thus far in the I-SEM balancing market this relationship has proven relatively weak. Numerous negative prices have even been observed, counter intuitively, during periods of a short market which has been primarily associated with the commercial offer data of certain demand side units. Given the risk averse nature of your average utility, these various inconsistencies of the BM are energising market participants with one market participant comparing the imbalance price calculation to a ‘random number generator’. The ‘flagging and tagging’ process by the TSO is provoking debate, on Wednesday evening there were both system and energy acceptances from the same unit at almost €1,000/MWh in consecutive periods. The interconnectors were not fully importing across this tightness as the last scheduling opportunity was the second intra-day auction at 08.00 that morning, again Friday evening volatility and tightness was primarily wind related.

Later in the week, the market was beginning to behave in a relatively more stable manner (5 minute imbalance prices still ranged from €100/MWh to €231/MWh across October 4th) with less volatility in wind and enhanced liquidity in the continuous market. The price spread between I-SEM and GB in the day ahead is quite narrow with on-going I-SEM outages maintaining prices slightly above GB.

The weekend was set to be an interesting one with wind volume forecast to peak Sunday afternoon/evening close to 3GW in I-SEM. We’ll provide a further updates over the coming weeks on how this played out and any further developments that emerge as the market settles in.

In the meantime, as with the GB electricity market, wind generators can remove their exposure from the imbalance price and align their electricity payments to the REFIT reference price, continuing to receive the maximum REFIT top-up payments. Please contact our team to discuss our Imbalance Management services which we provide across a number of contract structures.