The Process of Delivering Value

Xie Zhang, November 2021

The UK needs new flexibility and fast

From 1st October 2024, Great Britain will no longer use coal to generate electricity. The energy deficit caused by the closure of coal, nuclear and gas plants can be addressed by the development of new renewable capacity. However, wind and solar power is not enough to handle the rapidly increasing flexibility deficit. This is where batteries are set to play an important role.

Battery storage vs traditional thermal plant

Battery storage offers unique benefits as batteries can respond extremely quickly and accurately in either direction (import or export). The National Grid ESO Control Room takes advantage of this quality and frequently uses batteries to deliver short bursts of power, typically under a 10-minute duration. This is ideal for balancing intraday swings in wind, solar and customer demand. Traditional thermal providers, including the newer, more flexible gas peaking plants, cannot do this, because of their ramp rate and minimum off times.

Battery storage, however, has a limited lifespan before it needs to be recharged. Unlike a gas power station that could increase its power indefinitely, once the battery has discharged completely, it cannot sell any more energy. This must be recharged, either through trading or by waiting to be dispatched in the other direction.

The good news is that 2-hour batteries are now available on the market, and our own analysis at Erova shows that the sweet spot is between 1 and 2 hours for maximum value generation.

How does a battery make money?

Short answer is to stack the revenues across different markets, namely Dynamic Containment and the Balancing Mechanism.

Here is how Erova can help you get the most out of these two markets.

Batteries in the balancing market

The ESO Control Room makes sure that Great Britain has the essential energy it needs by making sure supply meets demand every second of every day.

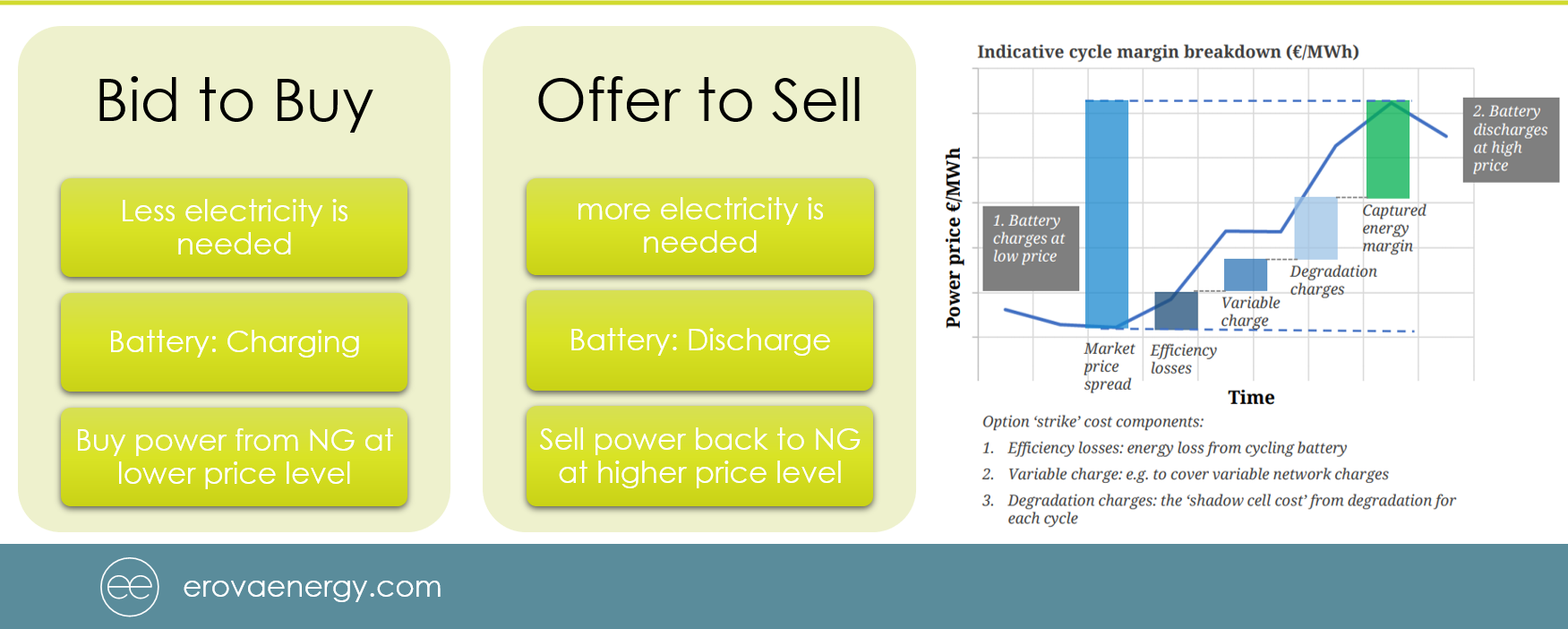

The Balancing Mechanism is manually dispatched by the ESO Control Room – providers submit Bids (to buy from the BM) and Offers (to sell to the BM) along with the related volumes, and only deliver (and are paid) when selected.

When more electricity is needed, National Grid accepts an offer from a provider. The battery is discharged and sends the power to the grid. If less electricity is needed, National Grid accepts a bid. The battery charges from the grid and removes electricity from the system.

A battery is effectively an option to move power from lower price periods (charging) to higher price periods (discharging). In another word, batteries can buy power from National Grid at lower price levels and sell power back to National Grid at higher price levels. Therefore, the higher the volatility, the higher the spread between low price and high price, creating more opportunity for a battery to generate positive revenue.

With high market volatility comes forecast risks, which need to be actively managed. Erova manages this risk using internal AI forecast models, second-by-second data monitoring and provides 24/7 trading.

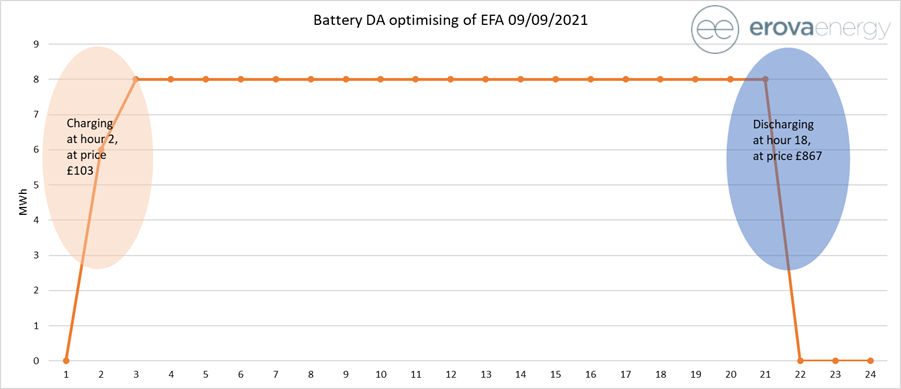

Batteries in the day-ahead market

There is another way to manage the risk and lock in revenue at day-ahead stage. The day-ahead wholesale market is relatively liquid. It comes with lower risk, but also lower volatility, which is good for creating a base layer of revenue. Utilising Erova’s systems, models and trader led optimisation, the high price period vs the low price period is straightforward to forecast.

Batteries in the dynamic containment market

A battery operator needs to co-optimise these wholesale and balancing revenues with other value streams, such as Dynamic Containment. Dynamic Containment is a new, fast-acting, dynamic post-fault frequency response service. It is the first of National Grid ESO’s (NGESO) new suite of frequency products, designed to stabilise grid frequency in case of large generation or consumption drop-outs.

This response to the drop-outs needs to be available and respond quickly when called. Batteries speed and flexibility make them particularly well-suited to the task. The National Grid buys baseload power from a battery at the day-ahead stage as a preparation with previous prices running at £17/MW/hour giving a daily revenue of £408/MW (£17*24hr).

This example shows revenue locked at £764/MW on a tight day.

Open Energi and Erova

Erova works alongside Open Energi on operating batteries across all value streams, we deliver full end-to-end optimisation through Trader Lead Automation. We help to decide which market is best to optimise revenue.

For example, on a comfortable day, with low day-ahead auction prices, a battery should stay in a Dynamic Containment contract and get paid at £408/MW as main revenue. This allows for Balancing Mechanism bids (to charge), while stacking some Balancing Mechanism revenue when called.

On a tight day, when the day-ahead auction is high enough, a battery should withdraw from a Dynamic Containment contract and move to day-ahead trading, getting paid over £408/MW along with the addition of intra-day and Balancing Mechanism participation on top.

Future opportunity

The latest developments from the National Grid ESO changes the Dynamic Containment contract from 24 hours to EFA Blocks since 15th September. We now see different clearing prices at varying EFA periods. This gives us more accurate market price signals, which increases market participation and, as the market develops and grows, increases liquidity.

Erova has been co-optimising across Dynamic Containment and the Balancing Mechanism for some time and can be seen on external leader boards as delivering maximum value across all providers. Going forward our future optimisation process will now include more dynamic participation across DC + DAH + BM with Erova being one of the few Battery aggregators with both N2EX and EPEX market access for multi-DAH price optimisations.

Click here to learn more about Erova’s Storage Optimisation Services or contact one of the Origination team.