Supporting the Path to Net Zero

Nick Williams, July 2022

Continued Growth

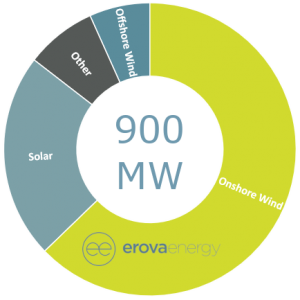

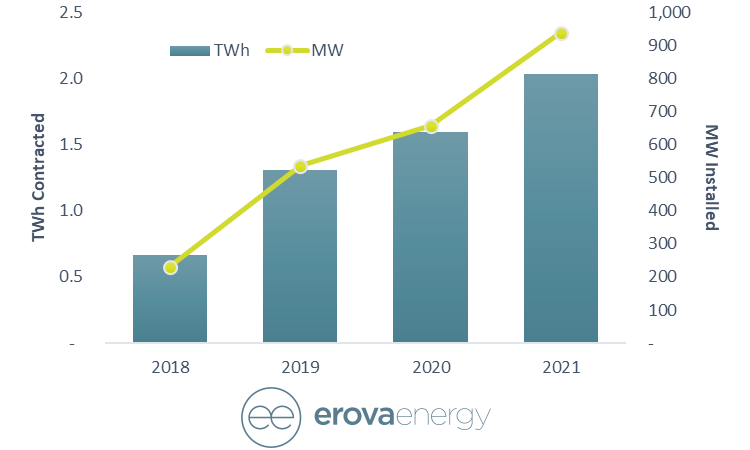

Since inception, Erova have always looked at ways to maximise trading value, reduce risk and bring more renewables to the market. Since taking on our first renewable portfolio back in 2018 we have grown from zero MWs under managements to over 800MW with an additional 100MW in flexible generation. We aim to reach over 1GW of renewables by the end of this year with at least 20% of the portfolio coming from subsidy free assets.

Core Markets

Although Erova trade in 5 core markets (Ireland, UK, Netherlands, France and Germany) and as we currently look to enter new markets, more on that soon, we really focus our asset backed trading services in Ireland and the UK.

In Ireland, our home ground, we have seen continued interest in our balancing service contracts. Providing a match against the REFIT market reference price and soon to be RESS market reference price.

For the UK, we have continued to develop our PPA structures and continue to provide fully tailored Route-to-Market access for both renewable and flexible generation. Unlike the Irish market which continues to develop a large number of subsidy back products, the UK is moving forward with a subsidy free portfolio of projects and Erova are working with developers to maximise the value of these merchant assets especially with additional revenue streams such as the Balancing Market.

For the UK, we have continued to develop our PPA structures and continue to provide fully tailored Route-to-Market access for both renewable and flexible generation. Unlike the Irish market which continues to develop a large number of subsidy back products, the UK is moving forward with a subsidy free portfolio of projects and Erova are working with developers to maximise the value of these merchant assets especially with additional revenue streams such as the Balancing Market.

Subsidy Free Power Purchase Agreements

At present, ~200MW of Erova’s PPAs are from subsidy free assets which are either fully merchant or backed by a corporate PPA. We provide low cost balancing services on a long tenor, up to 15 years. This means our generators are certain of their take home price £/MWh as their balancing is fixed alongside their corporate PPA price.

For fully merchant assets, Erova have developed their Balancing Mechanism access to allow for both large grid scale assets as well as small embedded assets to actively participate. Our AI driven price forecasts and dynamic pricing models allow for Erova to pro-actively monitor and manage the assets participation whilst remaining within the bid constraints set out in legislation (such as the TCLC).

Bankability

One of the key differentiators the large utilities bring to the market is their credit rating and ability to be a bankable offtaker. Over the past 3 years Erova have worked to generate a balance sheet capable of standing firm when reviewed by some of the leading project finance banks.

More recently we’ve received an independent rating from Dun & Bradstreet of 3A, presenting the low risk nature of Erova as a counterparty.