The I-SEM successfully launched yesterday with the first day-ahead hourly auction and intra-day auction. Day-ahead prices out-turned at a baseload price of €82/MWh, this appeared relatively high considering a day-ahead wind forecast of greater than 2GW for the evening peak (for comparison the last week of available SEM prices with similar availability profile and less wind generation had a baseload average of €73/MWh).

The main driver of prices relate to recent forced outages of the three Moneypoint units and a Kilroot unit (~1 GW of in-merit coal generation) and a scheduled outage at Great Island CCGT (400 MW). The equivalent GB baseload price was €75/MWh resulting in a predominant import flow on both EWIC and Moyle interconnectors, both interconnectors flipped to export for the evening peak corresponding with a high wind penetration in I-SEM.

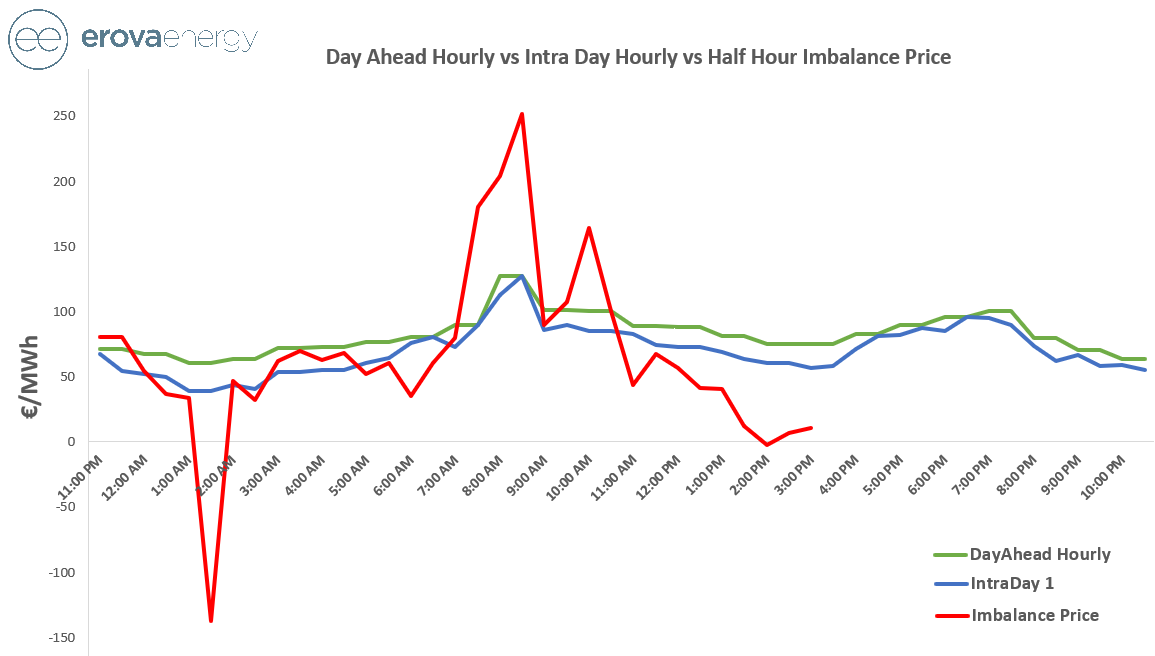

In terms of liquidity, 75 GWhs traded in day-ahead hourly auction with 10% of this volume traded in the first intra-day auction. Interestingly, the baseload price fell from €82/MWh to €70/MWh between auctions, perhaps related to thinner volumes in the intra-day auction. The intra-day 2 auction (11AM – 11PM) showed a further decline in prices by €3 for the equivalent periods to intra-day 1. Liquidity fears in for the continuous M7 market have been realised with very thin volumes traded across the day (low double digit volumes MW traded in each half hour), these sub-optimal liquidity conditions place increasing pressure on the participants to be balanced after the intra-day auctions.

The balancing market has proved incredibly volatile with 5 minute imbalance prices ranging from -€1,000/MWh (yes minus one thousand euro!) at 01.55 to +€381/MWh at 08.55 this morning. As anticipated, the wind delta versus forecasted wind is the main factor impacting the long / short direction of the market. Bizarrely, the -€1000/MWh price actually occurred during a short imbalance period. As is evident from the graph above, wind over-delivering versus forecast results in a very long market across the afternoon and was reflected in the imbalance price.

Whilst all of this was taking place, Erova announced it’s first Imbalance Management agreement with Greencoat (click here). We provide forcasting and balancing management with I-SEM, removing the exposure to such prices as seen today. To find out further details please contact our Origination Team (contact us).